TRUTH IN TAXATION

Please review the following notice and additional information.

To view the meeting packet click here.

To view the livestream click here.

Please review the following notice and additional information.

To view the meeting packet click here.

To view the livestream click here.

NOTICE:

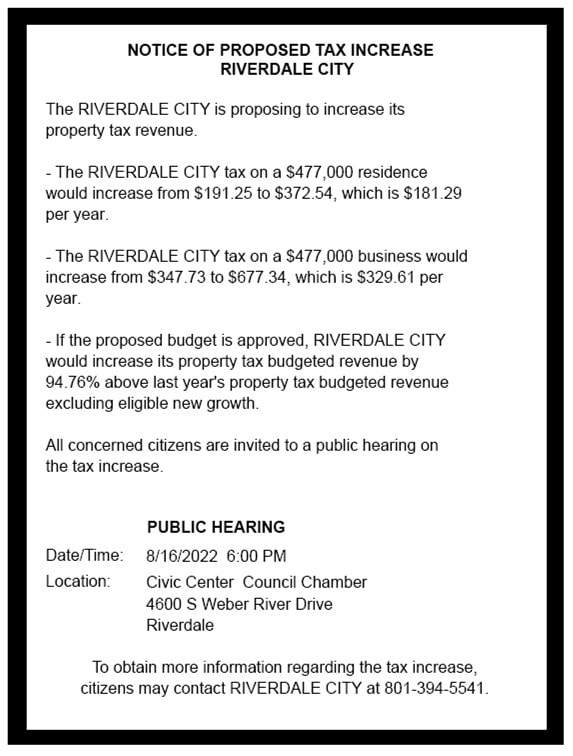

For the first time since 2010, Riverdale City is proposing to increase its property tax revenue. The increase in revenues are necessary to provide needed funding for our Public Safety (Police and Fire), employee retention, and to provide replacement revenues for significant businesses who have left. The maximum proposed increase would result in the following:

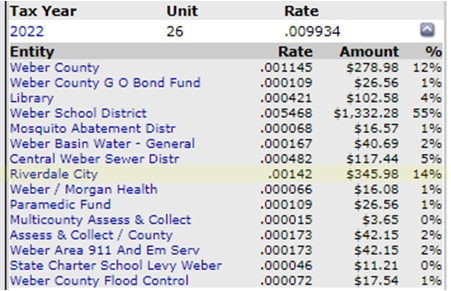

If the proposed budget is approved, Riverdale City would increase its property tax budgeted revenue by no greater than 94.76% above last year's property tax budgeted revenue excluding eligible new growth. This percentage only applies to Riverdale City’s portion of the property tax. If passed, the percentage of a home owners property tax allocated to Riverdale City will be only 14% of the entire assessment (see sample below). Currently 9% of your total property tax assessment goes to Riverdale City.

Riverdale residents have enjoyed a low tax rate compared to other cities. After the proposed increase, Riverdale City’s tax rate will still be lower than many of the other cities in Weber County.

All concerned citizens are invited to a public hearing on the tax increase.

PUBLIC HEARING

Date/Time: August 16, 2022 at 6:00 PM

Location: Civic Center Council Chamber

4600 S Weber River Drive

To obtain more information regarding the tax increase, citizens may contact Riverdale City at 801-394-5541.

For the first time since 2010, Riverdale City is proposing to increase its property tax revenue. The increase in revenues are necessary to provide needed funding for our Public Safety (Police and Fire), employee retention, and to provide replacement revenues for significant businesses who have left. The maximum proposed increase would result in the following:

- The Riverdale City tax on a $477,000 residence would increase from $191.25 to $372.54, which is $181.29 per year.

- The Riverdale City tax on a $477,000 business would increase from $347.73 to $677.34, which is $329.61 per year.

If the proposed budget is approved, Riverdale City would increase its property tax budgeted revenue by no greater than 94.76% above last year's property tax budgeted revenue excluding eligible new growth. This percentage only applies to Riverdale City’s portion of the property tax. If passed, the percentage of a home owners property tax allocated to Riverdale City will be only 14% of the entire assessment (see sample below). Currently 9% of your total property tax assessment goes to Riverdale City.

Riverdale residents have enjoyed a low tax rate compared to other cities. After the proposed increase, Riverdale City’s tax rate will still be lower than many of the other cities in Weber County.

All concerned citizens are invited to a public hearing on the tax increase.

PUBLIC HEARING

Date/Time: August 16, 2022 at 6:00 PM

Location: Civic Center Council Chamber

4600 S Weber River Drive

To obtain more information regarding the tax increase, citizens may contact Riverdale City at 801-394-5541.

Sample of a personal residence property tax distribution with the proposed increase (home valuation of $474,000).